New US businesses just starting up need to have the following information from the federal government:

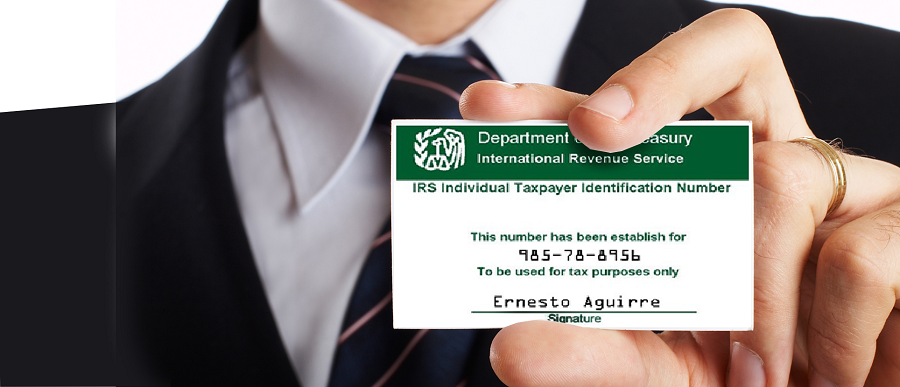

- US tax ID numbers

- ITIN number

- EIN number

These numbers are needed whether the company is setting up in the United States or a foreign country. For further information, you can go to https://ein-itin.com

EIN

An EIN is actually an “Employer Identification Number”, and in some cases referred to as FIN or “Federal Tax Identification Number”. This is used to identify a business entity and is issued with the sole purpose for using tax operations and is not required as needed for any other matters such as:

- Tax lien

- Closeout or deals

- Lotteries

- And others

Questions to answer

To understand if you need or are required to obtain an EIN – you do if you answer “yes” to one or more of the following questions:

- Do you have people working for you?

- Is your business an enterprise or association?

- Do you record any of these assessment forms such as Excise, Employment, or “Alcohol, Tobacco, and Firearms”?

- Does your business have a Keogh plan?

- Are you included with any of the types of associations;

- Involved with Estates?

Difference between Tax ID number and an EIN?

An EIN and Tax ID Number are exactly the same. An EIN is an Employer ID Number. A TIN is a Tax ID Number. A FEIN is a Federal Employer ID number. These are simply different names for the same number.

Process of getting EIN

This is a simple process; there is an online application that can be used when applying for a new Tax ID number from the IRS. You can either do this yourself, sending it into the IRS or you can hire a company that can help you with everything you need for setting up a new business.